15+ 250000 mortgage

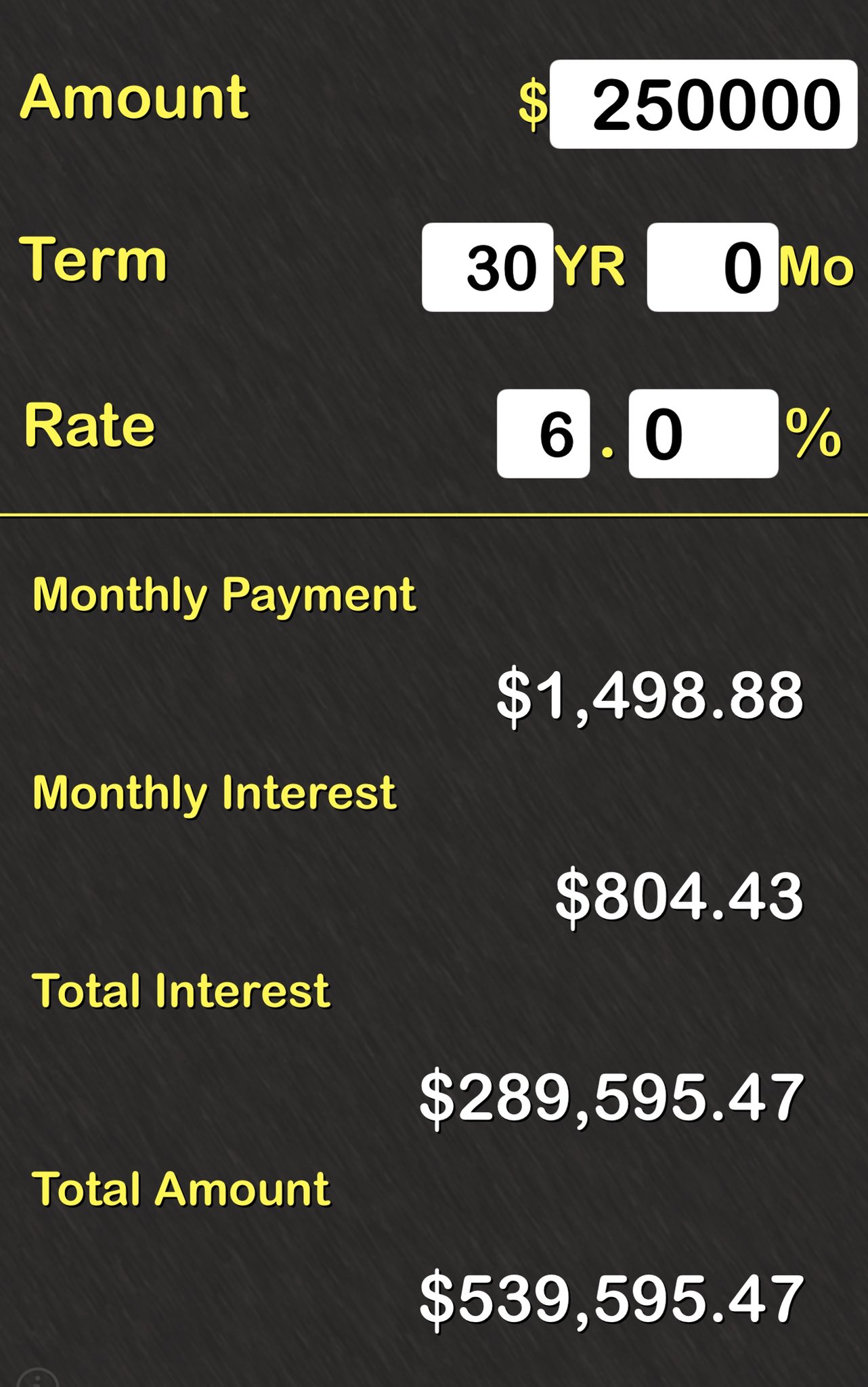

This does not include other additional costs. A mortgage calculator is a great tool that you can use to see how much you can realistically afford.

Canadian Home Buyers Now Need To Earn 150 000 Per Year To Buy A Typical Home R Canada

This calculator only shows the total accrued loan cost for the principal and interest.

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

. How do you calculate the total cost of a mortgage. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. APR and is based on a mortgage of 250000 with monthly payments of a 25 year amortization and assuming a processing fee of 250 such as the cost of determining the value of the property.

Thats about two-thirds of what you borrowed in interest. Your total interest on a 250000 mortgage. Extra Payment Loan Types and Points.

The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Banks current mortgage rates in Minnesota and see how residing in different states can impact your loan. Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer. Banks current mortgage rates in Arizona and see how residing in different states can impact your loan.

Taxpayers who file a joint return with their spouse may be able to. Before you start punching numbers into a calculator however you need to have a budget. IRS Tax Tip 2019-60 May 15 2019 The IRS has some good news for taxpayers who are selling their home.

Interest rate APR 38. And a maximum of between 250000 and 1000000 depending on the lender. Once youve saved enough funds and increased your credit score you may qualify for.

Learn more about US. Find the total cost over the life of a mortgage with this Total Cost Mortgage Calculator. Learn more about US.

Loan 30-Year Fixed Mortgage 15-Year Fixed Mortgage Difference. You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options. Which was a 15-year 250000 fixed-rate loan on a 312500 home.

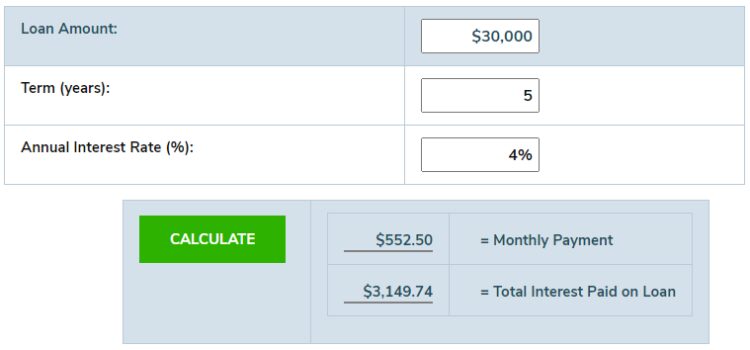

So on a 250000 loan one point would cost you about 2500. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our total amount repayable schedule over 15 and 30 years. Contact a home lending specialist today.

Compare current mortgage interest rates and see how you could get a 25 interest rate discount when you buy or refinance. So on a 250000 loan one point would cost you about 2500. Taxpayers who sell their main home and have a gain from the sale may be able to exclude up to 250000 of that gain from their income.

For your convenience current Boydton 30-year mortgage rates and 15-year mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. If there are no processing fees the APR and interest.

250000 300000 350000 400000 450000 500000 550000 600000 650000 700000 750000. And has an existing mortgage balance of 250000. Tax Tip 2019-60 May 15 2019.

See the monthly cost on a 250000 mortgage over 15 or 30 years. Includes fixed 15-year mortgage rates for conventional FHA and VA loans plus tips to find your best interest rate. A 30 year loan has 360 months a 15 year loan has 180 months.

However if you are not ready for a 15-year mortgage you may opt for a longer term. The Early-2017 Guide to Buying a Home March 10 2017. A 15-year mortgage costs you less since the total interest paid is less than a 30-year but there are both pros and cons to a 15-year loan.

If you are refinancing your mortgage a premium of 015 is added to the above interest rates. Their current mortgage. A 15-year loan for 250000 at 4 interest has a.

Compare and see which option is better for you after interest fees and rates.

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Cashless Countries Money Co Uk

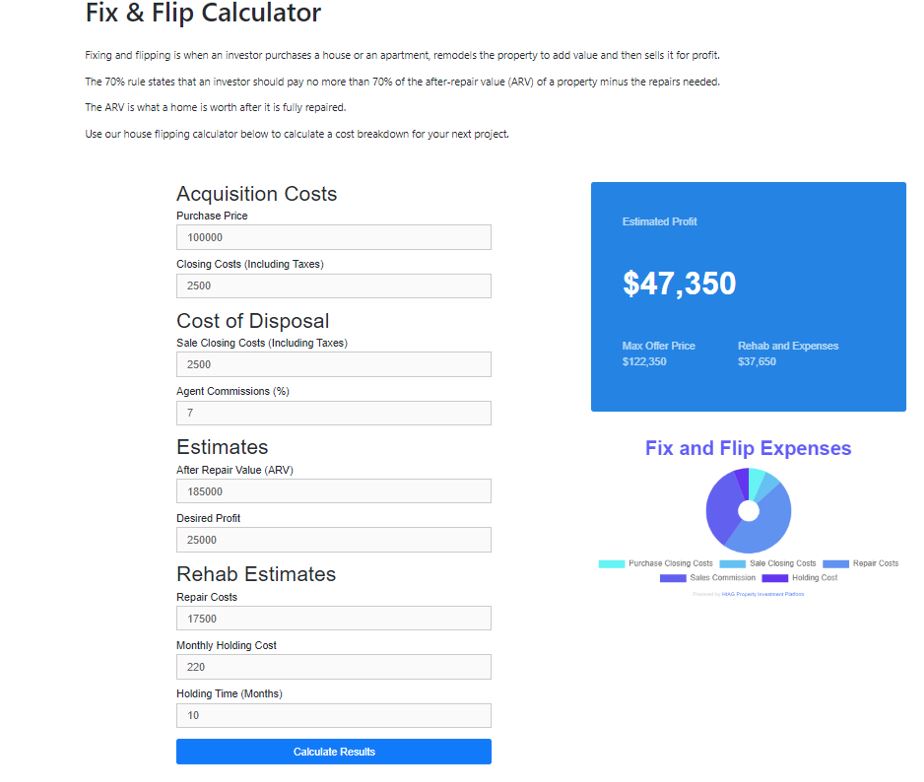

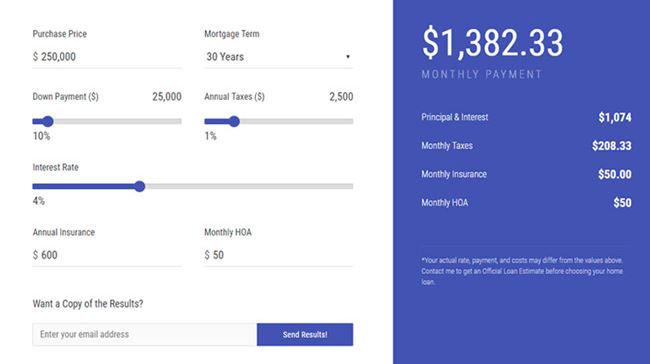

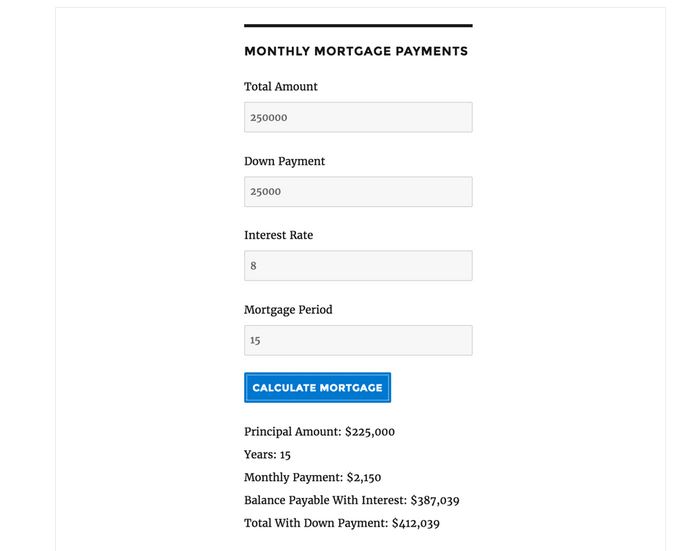

4 Real Estate Calculator Plugins For Wordpress Wp Solver

Top Tax Deductions For Second Home Owners

Mark Welti Real Estate Consultant Brookstone Realtors Linkedin

Canadian Home Buyers Now Need To Earn 150 000 Per Year To Buy A Typical Home R Canada

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Jeff Koelzer Jeffkoelzer69 Twitter

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Loan Interest Calculator How Much Will I Pay In Interest

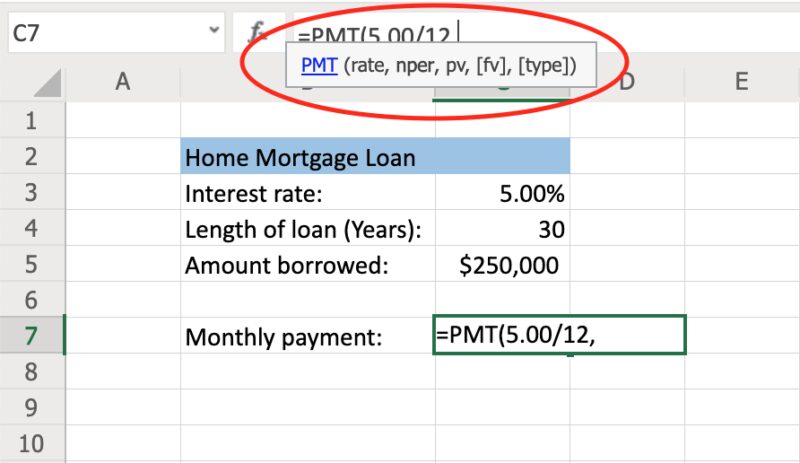

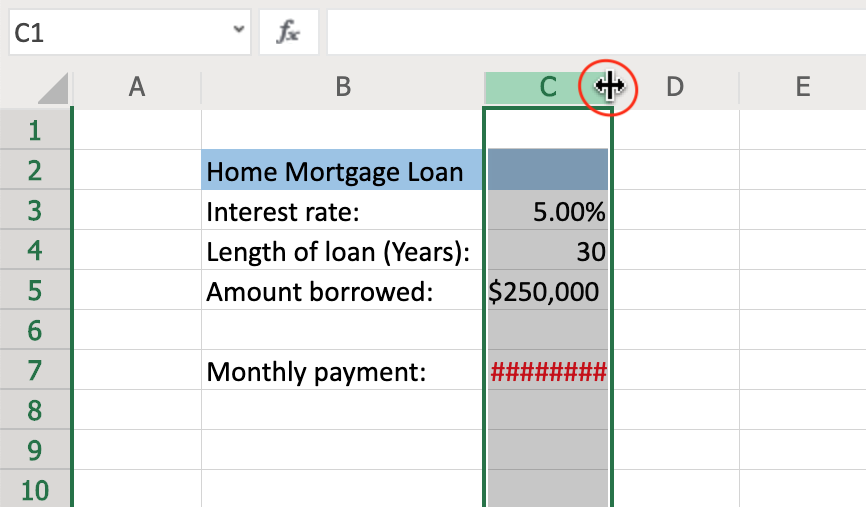

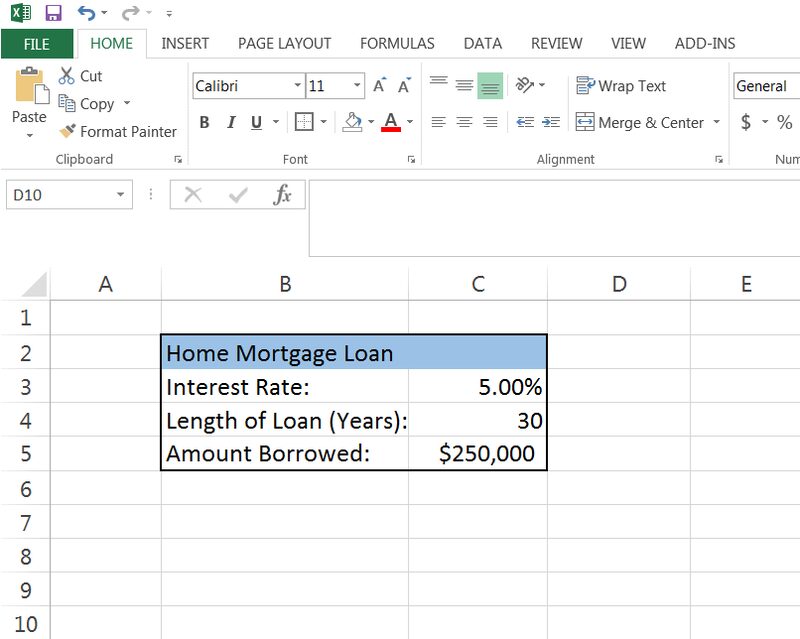

How To Calculate Monthly Loan Payments In Excel Investinganswers

How To Calculate Monthly Loan Payments In Excel Investinganswers

How To Calculate Monthly Loan Payments In Excel Investinganswers

4 Real Estate Calculator Plugins For Wordpress Wp Solver

2

What Is Mortgage Life Insurance

4 Real Estate Calculator Plugins For Wordpress Wp Solver